Unlock lucrative trading opportunities and find new liquidity.

Placing the power of AI-driven real-time data analytics in your hands

Scroll to continue

AI Market Analytics (AIMA) is instrument agnostic and designed for investors and traders, delivering a qualitative and quantitative solution based on personalised research capability.

AIMA

Test. Learn. Strategise. Available now!

Seize great trading opportunities using Leopard AI’s real-time analytics.

Leopard AI

FOR RETAIL INVESTORS

AIMA's AI-generated, human-readable sentiment analysis and real-time event-based alerting supercharges a user's ability to trade faster and smarter than ever before.

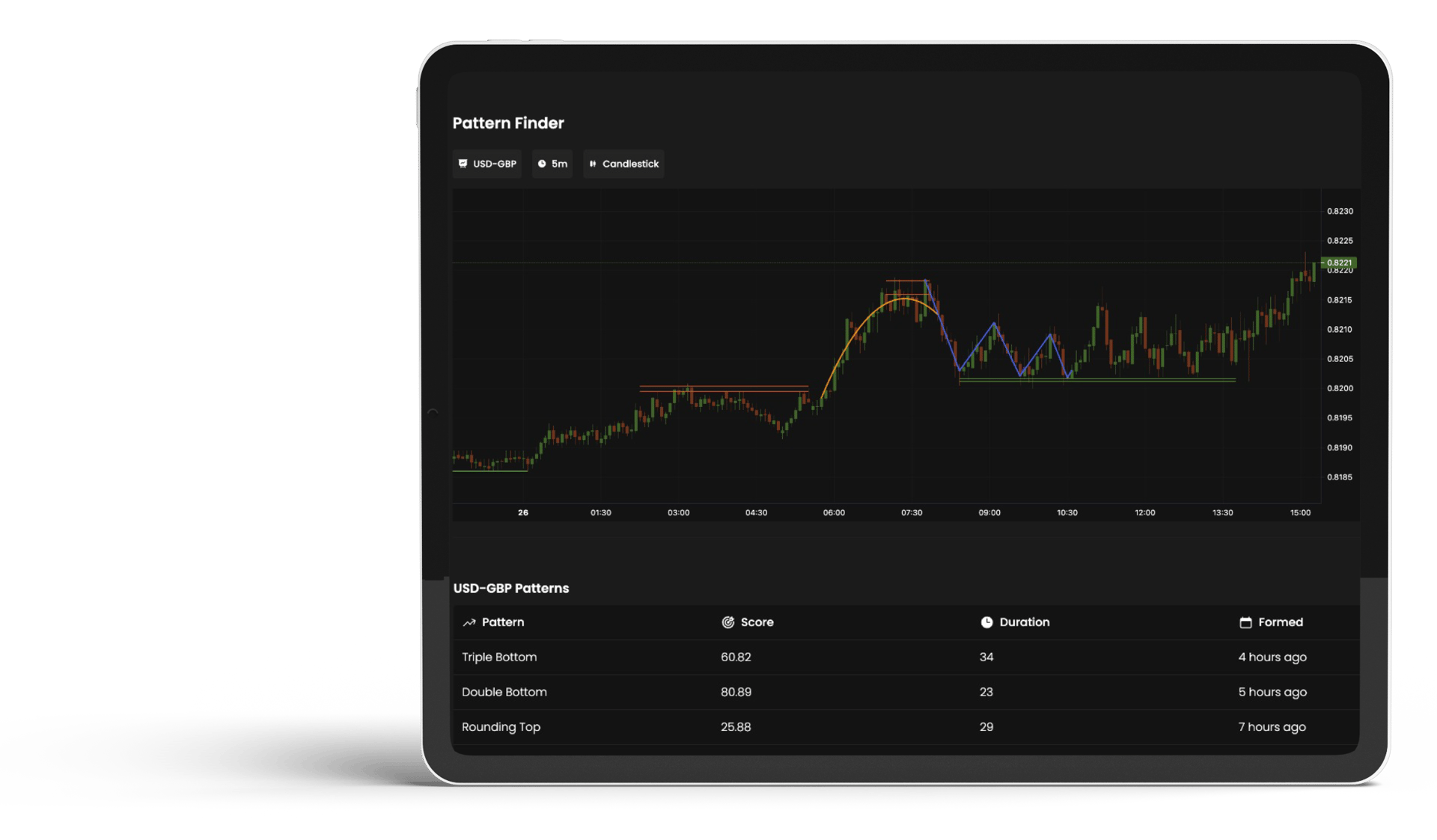

- Pattern Matching

- Advanced Engineering

- Advanced alerting screening and testing

Create alerts on your favourite patterns at any time series for both Forex and Crypto pairs so you never miss out!

Built on built on SIGMAs PaaS technology, Leopard AI will also have screening, backtesting, forward testing, sentiment analysis and a no-code algo builder coming soon!

FOR INSTITUTIONS

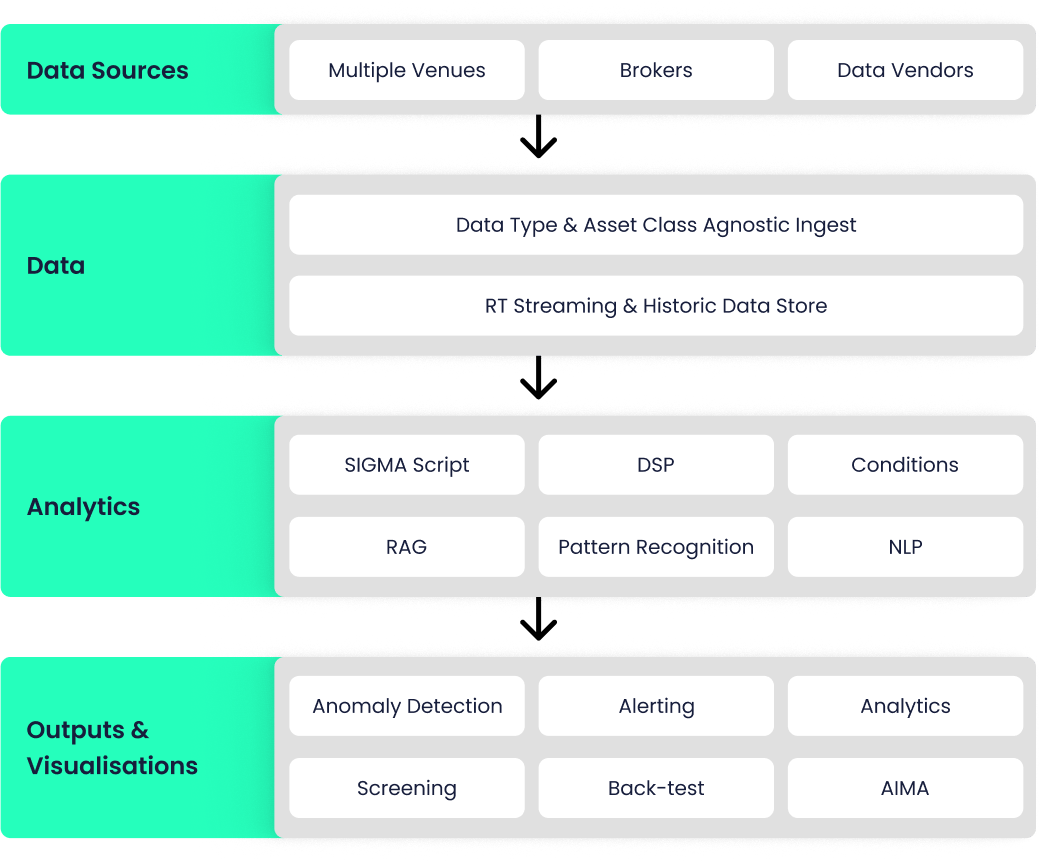

Modular scalable product suite driving smarter, faster, analytical trading decisions

AIMA delivers analysts and traders in-depth market analysis in natural language. Its dynamic real-time data analytics capabilities enable users to fearlessly hunt out emerging trends, pinpoint hard-to-find new liquidity opportunities and quickly formulate lucrative trading strategies with ease and precision.

AIMA uses a variety of sophisticated engineering and AI techniques, which applies highly sophisticated statistical processes to identify which aspects of large volumes of information are relevant while filtering out noise. AIMA handles both in-chart and off-chart data.

It is intuitive and easy to use, and all AIMA-derived information is fully customisable to suit client-specific preferences and data access requirements. Reports can be further personalised based on the end user's trading activities.

Innovative Engineering at the Core

ABOUT

Sigma Financial AI combines deep financial services experience and advanced engineering skills, forged through years of developing world-leading social media and music streaming technologies.

Patterns-as-a-Service (PaaS) is a real-time cloud-based trade signal generator.

PaaS

PRODUCT FEATURE

Both intrument and API agnostic, PaaS works with your existing order management flow, outperforming existing market patterns with astonishing accuracy.

PaaS can function as a standalone product or seamlessly integrate with the full suite of Leopard AI and Akili products. Want to incorporate PaaS into your system?

October 2 2023

FIA to Feature SIGMA Financial AI in Innovators Pavilion

SIGMA FINANCIAL

AI AT FIA

February 23 2024

SIGMA Financial wins the Shark Tank Award for our pitch in Miami

SIGMA FINANCIAL WINS AT TRADETECH FX

September 28 2023

Cutting-Edge, AI-based, no-code suite of tools for traders

LAUNCHING OF AKILI-AI

Latest News

March 12 2024

SIGMA Financial welcomes it's. new Chief Product Officer

SIGMA WELCOMES CPO RACHEL PRZYBYLSKI

3rd April 2023

SIGMA Financial AI Launches Seed 3 Funding Round to Fuel Product Expansion and Growth

SEED 3 Funding

2nd November 2022

SIGMA Financial AI Forms Strategic Partnership with Bristol Trading Society

PARTNERSHIP ANNOUNCEMENT

June 30 2023

SIGMA Financial AI Unveils Leopard AI: Empowering Retail Investors with AI-Powered Analytics

LAUNCH OF CLOSED BETA